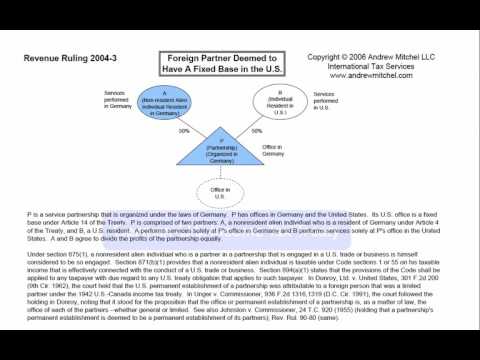

In revenue ruling 2004-3, a German individual owned fifty percent of a partnership organized in Germany, while a U.S. individual owned the remaining fifty percent of the German partnership. The German individual provided services in Germany through the German office, while the U.S. individual provided services in the U.S. through a U.S. office. As a result of the U.S. partner's activities in the U.S., the German partner was considered to be engaged in a U.S. trade or business. This led to the requirement for the German partner to annually file a U.S. tax return, reporting their portion of the partnership's profits earned in the U.S. It is important to note that the German-U.S. tax treaty did not prevent taxation of the partnership's U.S. profits to the German partner. Although not specifically addressed in this ruling, the German partnership would also need to file Form 1065, the U.S. Return of Partnership Income. Additionally, the German partnership would be required to quarterly withhold U.S. taxes at the highest statutory rate for individuals on all U.S. profits allocated to the German partner, in accordance with Code Section 1446. For further details on the required forms and guidelines, please refer to IRS forms 8804, 8805, and 8813.

Award-winning PDF software

Video instructions and help with filling out and completing Will Form 8804 Schedule A Instructions